Did you know that nearly 30% of life insurance claims are denied each year? This is often due to incomplete documentation or misunderstandings about policy exclusions. This statistic highlights the critical need to grasp the life insurance claim process. For beneficiaries, navigating this can be particularly daunting, adding to their already overwhelming situation. This guide aims to elucidate each crucial step, ensuring you are well-prepared when filing a claim. Our objective is to facilitate beneficiaries in obtaining the financial support they require, thereby reducing the stress during these trying times.

Key Takeaways

- The life insurance claim process can be complex but is essential for financial security.

- Understanding insurance claim steps is crucial for a timely payout.

- Being aware of common reasons for claim denials can help beneficiaries prepare.

- Gathering necessary documents before filing can expedite the claim filing procedure.

- Effective communication with insurers can ease the process.

- Seeking assistance from financial advisors can provide additional support during the claim process.

Understanding Life Insurance

Life insurance is a cornerstone in financial planning, offering a layer of security and peace of mind for families. Grasping the life insurance basics is vital for making well-informed decisions. Essentially, it is a contract between an insurer and a policyholder, where the insurer commits to paying a beneficiary a sum upon the policyholder’s demise. This financial safety net ensures that loved ones are financially protected during times of loss.

What is Life Insurance?

Life insurance acts as a financial shield, enabling individuals to prepare for the unforeseen. Policyholders pay premiums regularly in exchange for coverage, promising a payout upon death. This policy can mitigate financial stress related to funerals, debts, or loss of income.

Types of Life Insurance Policies

There are various types of life insurance to cater to different needs and preferences. Key options include:

- Term Life Insurance: This policy offers coverage for a set term, usually between 10 to 30 years. It is often more cost-effective and suited for those needing coverage during critical life stages, such as raising children.

- Whole Life Insurance: Whole life insurance provides lifelong coverage and includes a savings component. Premiums remain constant throughout the policy’s duration, making it a reliable choice for long-term financial planning.

- Universal Life Insurance: Universal life insurance offers flexible premiums and death benefits, allowing policyholders to adjust their coverage as their needs evolve over time.

Why Filing a Life Insurance Claim is Important

Filing a life insurance claim is paramount for the financial well-being of beneficiaries. The loss of a loved one can be devastating, and the financial support from a policy can ease immediate financial pressures. Understanding the significance of claims empowers beneficiaries to navigate this difficult time more effectively.

Financial Security for Beneficiaries

Receiving life insurance benefits offers critical financial support, ensuring beneficiaries’ stability. It serves as a protective measure against unforeseen expenses, allowing families to manage their daily costs. The funds can cover essential expenses, including mortgage payments, education costs, and other living expenses. Recognizing the financial security provided by filing a claim empowers beneficiaries during this challenging period.

Settling Debts and Expenses

Life insurance proceeds can aid in settling outstanding debts, such as personal loans, credit card balances, and funeral expenses. Many individuals may not appreciate the importance of timely claim filing in reducing financial strain. Accessing these funds alleviates beneficiaries from the burden of accumulating debts while they cope with their grief. For those seeking to protect their loved ones, exploring life insurance coverage can be highly beneficial.

Who Can File a Life Insurance Claim?

Identifying who is eligible to file a life insurance claim is paramount for the proper distribution of benefits. Generally, the individuals designated as beneficiaries in the policy are the primary claim initiators. In the absence of such designations, the estate executors take on the responsibility of filing the claim on behalf of the deceased.

Designated Beneficiaries

Those explicitly named in the life insurance policy as beneficiaries hold a critical role. It is imperative for them to verify their status with the insurance company, as this facilitates the claim process. Beneficiaries should adhere to the following guidelines:

- They must collect the necessary documentation to support their claim.

- Understanding their claim filing eligibility can prevent delays.

- Proactive communication with the insurer enhances the likelihood of a seamless process.

Estate Executors

In cases where a policyholder fails to designate beneficiaries, the estate executor becomes the claim filer. Executors play a unique role, encompassing:

- Reviewing the deceased individual’s will or estate plan.

- Confirming the insurance policy details and ensuring beneficial rights are exercised.

- Filing the claim while adhering to any legal or procedural requirements.

Initial Steps to Take After a Policyholder’s Death

The loss of a policyholder necessitates beneficiaries to act swiftly to initiate the claims process. Familiarity with the initial steps in claims can ease this difficult period. Adequate preparation and comprehension of the necessary documentation are key to expediting the claim resolution.

Gathering Necessary Documentation

Beneficiaries must first collect all required documents. The critical items include:

- The death certificate

- The life insurance policy document

- Identification of the beneficiary

- Any additional forms as specified by the insurance provider

Understanding these documentation requirements is crucial. Timely and accurate submissions facilitate quicker resolutions, alleviating the emotional burden on the family.

Contacting the Life Insurance Company

Subsequently, beneficiaries must promptly contact the life insurance company. This step commences the claims process. Ensure all documents are prepared for a seamless interaction. Many insurers have dedicated claims agents to assist beneficiaries. For insights on safeguarding your family’s future with life insurance, consult this resourceful guide.

The Claim Notification Process

Initiating a life insurance claim by promptly notifying the insurance company is paramount. Beneficiaries must expedite the completion of the claim form and submission of all required documentation. This approach facilitates a smoother process and mitigates potential issues stemming from delayed claim notifications.

How to Notify the Insurer

The notification process involves several critical steps:

- Gather relevant documentation, such as the policy number and death certificate.

- Contact the insurance company directly through their claims department.

- Fill out the claim form accurately, ensuring all required fields are complete.

- Submit the claim form alongside the necessary documentation via mail or electronically, depending on the insurer’s guidelines.

For additional guidance, refer to life insurance claims information from reputable sources.

Timeframes for Notification

Each insurance provider has specific deadlines for claim notifications, which can vary by state. Adherence to these timeframes is crucial for efficient claim processing. It is advisable to notify the insurance company immediately after the policyholder’s passing to circumvent complications arising from missed deadlines.

Required Documentation for Life Insurance Claims

Filing a life insurance claim necessitates a thorough understanding of the necessary documents. Familiarity with these claim documentation needs is crucial for a seamless process. Ensuring the collection of the correct paperwork is essential to prevent delays and complications.

Death Certificate

The death certificate is the cornerstone of the claim filing process. Insurers typically demand a certified copy of this document. It confirms the policyholder’s demise, initiating the claims process.

Policy Documents

Access to the original life insurance policy document is imperative. This document details the policy’s terms, including coverage amounts and claim-specific requirements. A meticulous review of this document is advisable to verify its accuracy.

Additional Required Forms

Aside from the death certificate and policy documents, additional forms are often required. These may encompass beneficiary designation forms or other insurer-specific requirements. Accurate completion of these forms is critical for the claims process’s efficiency.

Understanding the Claims Review Process

Upon submission of a claim, the insurance provider embarks on a meticulous process to evaluate the submitted data. This phase is pivotal in clarifying the path forward for claimants. It encompasses several key steps, including the verification of documents and the validation of claim authenticity.

What Happens After You File?

After a life insurance claim is lodged, the insurer meticulously examines the submitted documents. This phase is essential, ensuring that all information complies with the policy’s stipulations. The efficiency of this review significantly impacts the customer’s experience. Insurers may request supplementary documentation or clarification, promoting transparent communication throughout the review period.

How Long Does the Review Take?

The duration of the claim review varies, influenced by several factors, with typical periods ranging from a few days to weeks. The claim’s complexity often determines the resolution’s speed. Claimants should anticipate a waiting period while the insurer thoroughly evaluates the claim. Staying informed about these timelines is crucial for managing expectations. For those interested in potentially altering their insurance rates, consider comparing life insurance rates.

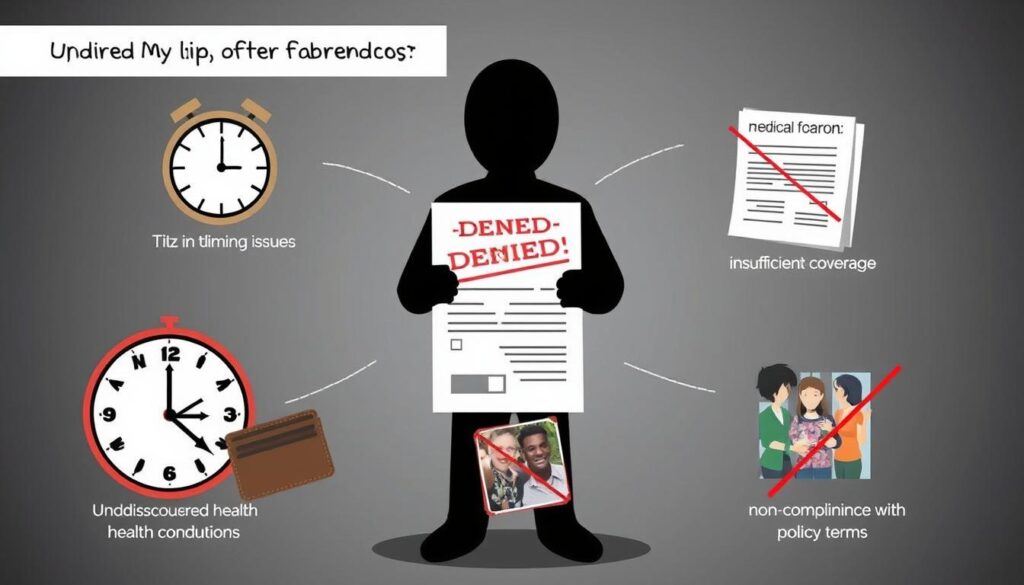

Common Reasons for Claim Denial

Filing a life insurance claim can be a daunting experience, especially when facing the possibility of denial. Understanding the common claim denial factors can empower beneficiaries and help streamline the claim process. Specific exclusions in the policy and insufficient or incomplete documentation are prevalent reasons for denied claims. Awareness of these elements can assist claimants in effectively preparing their submissions.

Policy Exclusions

Life insurance policies often contain exclusions that detail situations or circumstances under which coverage is not applicable. Familiarity with these exclusions can prevent surprises during the claims process. Some common exclusions include:

- Suicide within a specified contestability period

- Death resulting from illegal activities

- Pre-existing conditions not disclosed at the time of policy purchase

Being aware of these potential exclusions can significantly reduce the reasons for denied claims.

Incomplete Documentation

Another significant factor that affects the success of a claim is the lack of necessary documentation. Incomplete or inaccurate paperwork can lead to unnecessary delays or outright denial. Essential documents typically needed include:

- Death certificate

- Completed claim form

- Policy documentation

Ensuring all required documents are accurate and complete minimizes the chance of running into claim denial factors that could delay or jeopardize the claim outcome.

Overcoming Claim Denials

Facing a denied life insurance claim can be disheartening for beneficiaries. It is crucial to recognize that you possess the right to initiate the appeal procedure for denied claims. This avenue enables you to present additional documentation or explanations that might have been overlooked during the initial assessment.

How to Appeal a Denied Claim

The appeal procedure typically involves several steps:

- Review the Denial Notice: Understand the reasons for denial presented by the insurance company.

- Gather Documentation: Collect all necessary documents that support your case, including the policy, claim forms, and any additional evidence.

- Draft an Appeal Letter: Write a clear and concise letter explaining why the claim should be reconsidered, incorporating any new information.

- Submit Your Appeal: Send the appeal along with supporting documents to the insurance company, ensuring you follow up to confirm receipt.

Seeking Legal Assistance

If the appeal does not result in a favorable outcome, it may be necessary to seek legal help with claims. A knowledgeable attorney experienced in insurance law can provide guidance on potential next steps. They can assess the situation, help navigate complex legal terminology, and represent your interests effectively.

The Role of Financial Advisors and Insurance Agents

Financial advisors and insurance agents are pivotal in navigating the intricate life insurance claim process. Their expertise significantly impacts the outcome, offering beneficiaries crucial guidance and support during difficult times.

How They Can Help During the Process

These professionals provide invaluable financial advisor assistance. They help beneficiaries comprehend their options, ensuring all necessary documentation is submitted on time. This support alleviates the burden and accelerates the claims process.

Tips for Choosing the Right Advisor

The success of your claim heavily depends on selecting the right insurance agent. Consider the following when making your choice:

- Seek advisors with a strong reputation and credentials.

- Opt for those specializing in life insurance claims.

- Choose professionals who are transparent about their fees and services.

- Request referrals and read reviews to assess their effectiveness.

Tax Implications of Life Insurance Claims

Understanding the financial aftermath of a life insurance claim is paramount. Beneficiaries often grapple with the tax implications of their claims. They seek clarity on how life insurance taxation rules affect their benefits. This knowledge is crucial for effective financial planning.

Are Life Insurance Benefits Taxable?

Generally, life insurance benefits are not taxable income for beneficiaries. This means the total payout from the policy is not taxed as earnings. Nonetheless, beneficiaries must remain vigilant about any unique circumstances. For example, if the benefits are placed in an interest-bearing account, any accrued interest may be taxable.

Understanding Inheritance Tax

Inheritance tax is another critical consideration. While life insurance payouts are typically tax-exempt, they can impact the value of the deceased’s estate. If the estate’s value exceeds a certain threshold, it may face inheritance tax. Beneficiaries should consult with financial experts to grasp all tax implications. This ensures they can plan effectively.

The Impact of Waiting Periods on Claims

Grasping the nuances of waiting periods in claims is paramount for beneficiaries to adeptly traverse the labyrinth of the life insurance claim process. These intervals, which differ across various policies, exert a profound influence on the claims landscape. Acquaintance with typical waiting periods can mitigate anxieties, thereby facilitating more effective financial planning amidst the complexities of such a critical juncture.

Typical Waiting Periods Explained

Life insurance policies frequently embed waiting periods under certain conditions. For example, a prevalent clause mandates a two-year waiting period in cases of suicide. This measure is crucial for insurers to safeguard against fraud and uphold the sanctity of the claims process. Other scenarios might involve waiting periods for accidental deaths or specific health conditions.

When Do They Apply?

Waiting periods typically commence immediately upon the policyholder’s demise. Mastery over these periods is vital, as they directly influence the eligibility of beneficiaries to receive benefits. In instances where the event falls under policy exclusions, such as suicide or certain high-risk activities, claimants must be well-versed in the applicable timelines.

State Regulations Affecting Life Insurance Claims

Grasping the intricacies of state insurance regulations is paramount in the life insurance claim process. Each area is governed by distinct laws, profoundly influencing claim handling. Acquaintance with these regulations can avert unnecessary hurdles, ensuring a more streamlined experience for claimants.

Know the Laws in Your Region

Beneficiaries must actively seek knowledge of the regional claim laws pertinent to their circumstances. State insurance regulations delineate the prerequisites for a successful claim filing. Consulting with entities like the National Association of Insurance Commissioners can offer crucial insights into these mandates.

How Regulations Can Influence Claims

State regulations permeate multiple facets of the claims process, encompassing documentation necessities, claim approval timelines, and beneficiary rights. This legal framework prescribes the inquiries to be addressed and the evidence to be furnished during the claims procedure. Mastery of these regional claim laws equips beneficiaries to adeptly traverse the system, ensuring their rights are upheld.

Tips for a Smooth Claim Process

Filing a life insurance claim can be a daunting task. Employing effective strategies is crucial for a seamless claims process. Mastering the art of managing correspondence and maintaining records can profoundly impact the outcome.

Keeping Accurate Records

Accurate record-keeping is paramount. Document every interaction with the insurer, capturing names, dates, and key points discussed. This not only aids in tracking progress but also serves as irrefutable evidence in case of disputes.

Effective Communication with Insurers

Regular communication with the insurance company is essential. Respond to inquiries promptly and clarify any ambiguities directly. Such openness can expedite the claim’s resolution and prevent potential complications.

What to Do If You Experience Delays

Dealing with delays in the life insurance claims process can be a source of significant frustration for beneficiaries. Understanding the common causes of these setbacks is crucial. By proactively addressing these issues, individuals can expedite the claims process efficiently.

Common Causes of Delays

Several factors contribute to delays in processing life insurance claims. These include:

- Incomplete documentation submitted at the time of filing.

- Slow response times from the insurance company.

- Inaccurate or missing information on the claim forms.

- Verification processes that take longer than usual.

Steps to Expedite Your Claim

Beneficiaries can take proactive measures to speed up the claims process. Consider the following steps:

- Double-check all documents to ensure completeness before submission.

- Follow up regularly with the insurance provider to stay updated on your claim status.

- Clearly communicate with the insurer about any issues that arise.

- If necessary, seek assistance from a professional to navigate the process efficiently.

For more information on navigating potential delays, visit this resource. Taking these steps can significantly aid in handling claim delays and contribute to expediting claims, ultimately facilitating a smoother experience during what can be a challenging time.

Continuing Support After a Claim

After a life insurance claim is settled, beneficiaries often require ongoing support. This support encompasses both emotional and financial assistance. It is vital to address these needs to facilitate a smooth transition and ensure long-term stability.

Emotional and Financial Resources

Receiving a monetary benefit can evoke a spectrum of emotions in beneficiaries. Seeking post-claim support, such as counseling, is crucial for emotional processing. Additionally, exploring financial resources is essential for making informed financial decisions. Beneficiaries may consider the following options:

- Therapeutic support groups and individual therapy sessions

- Workshops on financial literacy and budgeting

- Consulting with financial planners to outline a sustainable financial strategy

Long-term Planning for Beneficiaries

Engaging in long-term planning is key to enhancing beneficiaries’ financial well-being. Assessing immediate expenses and planning for future needs ensures the effective use of life insurance benefits. Beneficiaries should consider various strategies, including:

- Establishing an emergency savings account

- Diversifying investments to balance risk and growth

- Reviewing insurance policies to guarantee adequate protection

By taking these steps, beneficiaries can confidently navigate their new financial landscape. They can make decisions that align with their goals for stability and growth.

Conclusion: Navigating the Claim Process Successfully

The initiation of the life insurance claim process can be daunting for many beneficiaries. However, a thorough comprehension of the required steps can significantly ease this burden. Adherence to the outlined guidelines and meticulous organization, facilitated by the collection of crucial documents, are essential for a successful claims journey.

Moreover, being well-versed in one’s rights within the claims framework empowers claimants to tackle the intricacies with assurance. Employing effective claim navigation strategies, such as maintaining open communication with the insurance provider and documenting events accurately, can notably streamline the process.

In conclusion, a proactive and well-prepared approach to the claims process ensures compliance with all stipulations, thereby offering solace during a potentially distressing period. By focusing on these strategies, beneficiaries can navigate the complexities of life insurance claims more efficiently, thereby reducing the associated stress.

FAQ

What is the life insurance claim process?

The life insurance claim process is a series of critical steps initiated by notifying the insurer of the policyholder’s demise. It culminates in the submission of necessary documentation. Beneficiaries must grasp and adhere to the claim filing procedure to expedite the process. This ensures timely receipt of financial support.

How can I file a claim for life insurance benefits?

To initiate a claim, a designated beneficiary must contact the insurer to obtain a claim form. Upon completion, the beneficiary must compile the required documentation, including the death certificate and policy documents. These must be submitted along with the form, adhering to the insurer’s claim filing procedure.

What are the required documents for claiming life insurance?

The primary documents for a life insurance claim include the death certificate, original policy documents, and any additional forms, such as beneficiary designation forms. Ensuring the completeness and accuracy of these documents is crucial to avoid delays in the claims process.

How long does the claim review process take?

The duration of the claim review process varies, spanning from a few days to several weeks. The timeline is influenced by the claim’s complexity and the quality of documentation provided. Beneficiaries can inquire about their claim’s status to remain informed.

Why might a life insurance claim be denied?

Claims can be denied due to policy exclusions, incomplete documentation, or discrepancies in information. Understanding these common reasons helps beneficiaries prepare adequately when submitting claims, thereby reducing the risk of denial.

What should I do if my claim is denied?

If a claim is denied, beneficiaries have the right to appeal. This involves following the insurer’s appeal procedure, which typically requires additional documentation and an explanation for the appeal. Seeking legal counsel may be advisable for complex cases.

How can financial advisors help with the claims process?

Financial advisors offer invaluable support by explaining options, assisting with documentation, and ensuring effective communication with the insurer. An experienced advisor can significantly influence the claim’s success.

Are life insurance benefits subject to taxation?

Generally, life insurance benefits are not taxable as income for beneficiaries. However, understanding potential inheritance tax implications and other tax considerations is crucial for effective financial planning post-claim payout.

What are typical waiting periods for life insurance claims?

Some policies have waiting periods before benefits are paid out, especially in cases of suicide. Beneficiaries must be aware of these waiting periods, as they impact when benefits are received.

How do state regulations influence the claims process?

State-specific insurance laws can significantly affect the life insurance claim process. Familiarity with these regulations ensures compliance and facilitates smoother navigation through the claims process, avoiding unnecessary delays.

What steps can I take to ensure a smooth claims process?

To ensure a smooth claims process, maintaining accurate records of all communications and responding promptly to insurer requests is crucial. Having all required documentation ready for submission is also vital. Clear communication helps resolve any uncertainties efficiently.

What resources are available for beneficiaries after settling a claim?

After settling a claim, beneficiaries can access emotional support and financial resources. Exploring counseling services and engaging in long-term financial planning can aid in effectively utilizing the benefits for stability and security.